Engagement & Retention project | INDmoney

First things first - What is INDmoney all about?

INDmoney is an all-in-one "super money app" which aims to simplify financial management for Indian users by offering a comprehensive platform for tracking, investing, and growing wealth.

- Founded in 2019 by Ashish Kashyap, a serial entrepreneur who previously founded the Ibibo Group and PayU India

- # Users - 1 crore+

Features and Core Value Prop

🆓 Free Account with zero maintenance charges

🆓 Free Account with zero maintenance charges

🏅Invest in stocks, MFs, ETFs, FDs - all from one place

🤏Start small, build a habit - SIP in stocks with as low as Rs. 10

🌎Invest in US stocks as easy as 1, 2, 3...

🤑Track your net worth and achieve all your investment goals!

What are the users saying [gathered via user interactions(Primary Research) and external platforms(Secondary Research)- App store/Play store, Reddit etc.]

What do they like 😀 | What do they don't like 😡 |

|---|---|

|

|

Overall, INDmoney appears to be a popular choice for users seeking a comprehensive financial management tool, particularly for those interested in US stock investing. However, concerns about data privacy, customer support, and occasional technical issues are notable drawbacks mentioned by users across various platforms.

Understanding Core Value Proposition

For young, tech-savvy Indian professionals who want to simplify their financial management and grow their wealth, INDmoney is an all-in-one super finance app that provides comprehensive tracking, investing, and wealth management tools in a single, user-friendly platform.

Active Users for INDmoney

Active User = Someone who has invested at least once per month or has actively linked at least one investment asset per month.

Natural Frequency & Engagement Framework

The natural frequency of INDmoney is Monthly - Why? Considering salaried professionals as the primary target segment(all ICPs), the need to invest/track would naturally be once a month around the time when the salary is credited (Use case of active investments or tracking passive investments).

Engagement framework / How to target - Breadth is the appropriate framework for INDmoney since the more the users engage with a product feature that simplifies investment decision-making for them > The more confidence they will get in making their next investment move >In turn, they will invest more in one or multiple asset classes via the app (CVP) > Increased user engagement & revenue for INDmoney 💰

🎯WHO TO TARGET - Basis use-case vs frequency framework, we can say that active investors can be segmented into core, power & casual users as follows:

Parameter | Casual 😏 | Core 👌 | Power 💪 |

|---|---|---|---|

Natural Frequency | 1/Month | 2-4/Month | >1/Week |

OR | |||

CVP being utilised <> Commitment with the product in terms of money being distributed across different assets | Invested in 1 instrument/Using only tracking features | Invested in 2 instruments + using tracking features | Invested in >2 instruments + using tracking features |

Level of engagement | Low | Med | High |

🙅 Not considering MONEY as a parameter here since it depends on the investment capacity of an individual > A casual user can be investing Rs.1 lakh per month only on Mutual funds once a month vs a power user can be actively investing ~50k but diversified their investments in different assets across US stocks, MF, deposits etc. |

Ideal Customer Profiles for INDmoney 🤑

Criteria | ICP1 | ICP2 | ICP3 | ICP4 |

|

|

|

| |

Name | The Experienced Millennial | First Time Investor | The Family Planners | Affluent Investors |

Description | Professionals who are in the early stages of their career | Fresh graduates or early career professionals | Young parents or couples planning to start a family | Mid- to senior-level professionals or entrepreneurs |

Demographics & Social Characteristics | ||||

Age | 25-30 | 22-28 | 30-40 | 28-50 |

Income level | ₹10-20 lakhs p.a. | ₹6-12 lakhs p.a. | ₹20-40 lakhs p.a. family income | ₹20+ lakhs p.a. |

Demographics | Urban areas, particularly in Tier 1 | Mix of both Tier 1 & 2 | Urban areas, particularly in Tier 1 | Tier 1 |

Where do they spend time | LinkedIn, Instagram, YouTube | Instagram, TikTok, YouTube | Facebook, Instagram, Pinterest, LinkedIn | Instagram, LinkedIn, Twitter, Bloomberg, CNBC |

Interests | Financial independence, tech, fitness | Side hustles, personal growth, tech | Family planning, real estate, fitness | Luxury, travel, business, estate |

Other characteristics |

|

|

|

|

Investment Characteristics | ||||

Investment Knowledge/Experience | Basic to Intermediate | Novice to Beginner | Intermediate to Advanced | Intermediate to Advanced |

Major decision factors/Levers | Financial news, Finfluencers, Peer recommendations, Desk research | Finfluencers, Social media, Word of mouth | Word of mouth/ Peer recommendation, Finfluencers | Financial news/articles, Desk research, Peer recommendations |

Current apps used for investments | Groww, Zerodha, Upstox | Zerodha, Groww, Paytm Money | ET Money, Groww, Zerodha | HDFC Securities, Zerodha, Groww |

Investment goal/motivation | Wealth building, early retirement | Start investing, long-term growth | Secure kids’ future, home ownership | Retirement, wealth preservation |

Preferred Investment Assets | Stocks, Mutual Funds, SIPs | Mutual Funds, SIPs, ETFs | Mutual Fund, SIPs, Real Estate, Gold, FD | US Stocks, Indian Stocks, Deposits, Real Estate, Bonds, Gold |

Primary Need | Simple, intuitive investment tracking | Easy onboarding, educational tools | Family joint planning, tax-saving tools | Advanced wealth management, diversification |

Pain Point | Time constraints, investment confusion Overwhelmed by multiple investment apps - difficult to maintain and track investments across multiple assets and apps | Overwhelm from investment complexity, fear of loss, lack of guidance Don't know where and how to start | Difficulty in managing family finances (goals and expenses), tax-saving, coordinating joint investments with spouse. Need portfolio analysis at family level |

|

Features they're looking for | Easy-to-use interface, automated portfolio tracking, low-cost solutions | Educational content, risk management, easy-to-understand portfolios | Family budget management, tax optimization, joint accounts, goal tracking | Advanced investment options, tax-saving strategies, wealth diversification, Transparency

|

Solution | Simple investment management, automated recommendations, financial literacy tools | Beginner-friendly tools, bite-sized financial education, low-risk options | Family account management, family-oriented investment solutions, tax-efficient planning tools, financial goal-based advice | Advanced portfolio management, tax optimization, personalized financial goal-based advice |

Marketing Pitch | "Invest smart, grow wealth effortlessly, even with a busy schedule." | "Start your investing journey with confidence—easy, fun, and educational." | "Build wealth together, secure your family's future with a seamless financial plan." | "Maximize your wealth with tailored solutions, tax strategies, and premium services." |

Perceived Value of Brand | Convenience, and prefers affordable options, but willing to invest in ease of use | Educational content, simplicity, and low-risk options | Joint financial management and security-focused features | Premium value, associated with personalized advice, exclusive tools, and diversified wealth management options |

Willingness to switch & what will make them switch | High readiness, open to tech-driven solutions & appreciates clear benefits and ease of use | High readiness, highly open to educational, low-risk, user-friendly solutions | Medium-high readiness, open to innovative solutions that align with family-centric financial goals | Low-medium readiness, prefers proven, high-value solutions but open to innovative wealth management & diversification tools |

Money/Time > Money | Med | Low | Med | High |

Approach for selecting ICPs (MECE)

- Already invested

- Invested in only one asset type via one app >

- Responsibility for family > No > No need/motivation to shift platform unless loss of trust

- Responsibility for family > Yes > Track money for family and set goals > FAMILY PLANNERS - ICP3

- Invested in more than one asset type via one app >

- Active/Exploring new ways to invest in new asset classes > SUPER MONEY APP + PORTFOLIO TRACKING(SECONDARY) - ICP1 & ICP4

- Passive/Non-explorer > No need/motivation to shift platform unless loss of trust

- Invested in more than one asset type via multiple apps > SUPER MONEY APP + PORTFOLIO TRACKING(SECONDARY) - ICP1 & ICP4

- Not invested > NEW INVESTOR - ICP2Cutting across - People who specifically want to invest in US/Global market - ICP4

ICP Prioritization

Criteria | Adoption Rate | Appetite to invest/transact | Frequency of Usage | Distribution Potential | TAM (Users) |

ICP 1 - The Experienced Millennial | High | Med | High | High | High |

ICP 2 - First Time Investor | Med | Low | Med | Med | High |

ICP 3 - The Family Planners | Med | Low - Med (Juggling family expenses) | Med | Med | Med |

ICP 4 - Affluent Investors | Med | High | Med | Low | Med |

From the ICP Prioritization Framework, ICP1 clearly stands out and out of the rest, we can see that ICP4 should be focused upon as well since their appetite to transact is on the higher end and money being a crucial factor for a financial investment app. Both also have a very strong use case of the product. Bingo!

Leveraging BREADTH as the engagement framework - The more the users use a product feature that simplifies investment decision-making for them > The more confidence they will get >In turn, they will invest more in one or multiple asset classes via the app > Increased user engagement & revenue for INDmoney 💰

🎯 Goal

To simplify investment decision-making for users, transitioning them from Casual users → Core users → Power users by new feature development of AI-driven personalized investment recommendations with one-tap execution.

🚨 Problem Statement

Many INDmoney users hesitate to invest in multiple assets due to:

- Decision paralysis: Too many investment options create confusion.

- Lack of knowledge: They don't know which asset suits their financial goals. Users open the app but don't take action due to lack of confidence.

- Risk perception: Users fear losses and need guidance on safe diversification.

🔄 Current Alternatives

- DIY Research via blogs, YouTube, or financial advisors.

- Competitor Apps like Zerodha, Groww, and Kuvera that offer asset discovery but lack AI-driven personalization.

- Trusting Friends/Influencers for investment recommendations.

Problems with Alternatives:

- Time-consuming & overwhelming.

- Generic, non-personalized advice.

- No integrated execution & tracking.

🚀Here comes our solution - "INDmoney - Paisa Buddy" 🚀

Hook - "Your AI-powered personal investment advisor—simplifying your next financial move in just one tap!"

How It Helps Users Make Investment Decisions Easily

Many users hesitate before investing due to lack of clarity, overwhelming options, and fear of risk. The Wealth Navigator solves this by offering:

✅ AI-powered, real-time investment recommendations based on user behavior, goals, and market trends.

✅ Simplified, one-tap investment flows that reduce decision paralysis.

✅ Scenario-based simulations to help users visualize potential returns across different asset classes.

Feature Breakdown

1. "Smart Suggestions" for Portfolio Expansion

- AI-driven hyper-personalized investment recommendations based on:

- Past investments

- Market conditions

- User goals

- Risk appetite

- Example: "You've invested in Indian equities. Adding a global ETF can balance your portfolio—get started with ₹5,000!"

📌 User Action: One-tap "Invest Now" button with a pre-selected amount & rationale.

2. "What-If" Investment Simulator

- Users can enter an investment amount, and the tool forecasts potential returns across different asset classes.

- Example: "If you invest ₹10,000 in US Stocks today, you could earn ₹12,500 in 3 years (7.5% CAGR)!"

📌 User Action: Compare multiple assets & make informed decisions instantly.

3. "Smart Alerts" for Timely Investments

- Instant alerts when:

- A stock they follow hits a target price.

- A market dip/global news or event presents a buying opportunity.

- An upcoming IPO or fund is aligned with their past investments.

📌 User Action: Tap to invest instantly without deep research.

4. "Investment Readiness Score/Portfolio Health Report"

- AI scores users on their investment behavior, nudging them towards diversification.

- Example:

- "Your portfolio score is 65/100. Adding a debt fund can improve balance—here’s a recommendation!"

📌 User Action: Click to optimize portfolio in real time.

5. "INDmoney Expert AI Chat"

- AI-powered conversational assistant that answers investment queries like:

- "Should I invest in Gold vs. US Stocks?"

- "How much SIP should I do for ₹1 Cr in 10 years?"

- Uses real-time market insights to give actionable, personalized answers.

📌 User Action: Get instant insights & invest based on AI-backed responses subject to regulations.

Why This Works as a Hook

🔹 Reduces decision fatigue → Makes investing intuitive & effortless.

🔹 Leverages AI personalization → Each recommendation is unique to the user.

🔹 Encourages action, not just browsing → Clear CTAs with instant investment flows.

🔹 Gamifies portfolio optimization → Nudges users towards becoming power investors.

🎯 Metrics to Track

1️⃣ Adoption Metrics

- % of users engaging with Wealth Navigator.

- Click-through rate on AI recommendations.

2️⃣ Investment Behavior Metrics

- % increase in multi-asset investors.

- Average investment per user before vs. after using Wealth Navigator.

3️⃣ User Retention & Activation

- Monthly Active Users (MAU) engaging with the feature.

- % of dormant users reactivated through recommendations.

4️⃣ Monetization Metrics

- Increase in transaction volume via INDmoney.

- % of Wealth Navigator users opting for premium features (if applicable).

📈 Ramp-Up Milestones

🚀 Phase 1 (Beta - Month 1-2)

- Launch MVP with AI-driven asset recommendations.

- A/B test different UI versions to optimize engagement.

- Collect feedback from early adopters.

⚡ Phase 2 (Expansion - Month 3-6)

✅ Introduce scenario-based return simulations to improve decision-making.

✅ Add Smart Alerts for real-time investment opportunities.

✅ Partner with financial influencers for education-driven engagement.

🔥 Phase 3 (Scaling - Month 6-12)

✅ Optimize AI personalization to refine user recommendations.

✅ Launch gamification & rewards to increase repeat investments.

✅ Integrate community features (user Q&A, expert insights).

Using complimentary engagement campaigns, we will focus on the transition of users from App install > Casual > Core > Power users!

Campaign Parameters | Campaign 1 - Launch of the product hook (Paisa Buddy) | Campaign 2 - "Expand Your Wealth" Challenge (Gamification Campaign) | Campaign 3 - "Power Portfolio" Personalized Recommendations | Campaign 4 - "Portfolio Growth Days" (Limited-Time Flash Campaign) | Campaign 5 - "Super Investor Streaks" (Gamification + Habit Formation) |

Target user segment |

| Casual users who have invested in only one asset class (e.g., Mutual Funds or US Stocks). | Core users (2 asset classes) who haven’t expanded to more / have medium engagement. | Users with a stagnant portfolio (no new investments in 45+ days). | Casual & Core users who invest sporadically. |

Goal of the campaign |

| Encourage users to explore a second asset class (e.g., Gold, Bonds etc.). | Encourage users to become power users by investing in their next asset class. | Reactivate less active users by incentivizing portfolio growth. | Build consistent investment habits to increase retention. |

Pitch/Content | "Smart Investing, Made Simple!"

| "Smart investors diversify! You’ve started strong—now take the next step to maximize your wealth with another investment class. when you invest in a new asset." | "Your portfolio is growing—now let’s optimize it! Based on your investments, we recommend diversifying into (personalized asset suggestion: REITs, Gold, ETFs, Bonds, etc.) to boost returns and reduce risk." | "Your portfolio has been waiting! This week only, unlock a special bonus when you grow your investments!" | "Consistent investors see the best returns! Build your streak—invest for 3 consecutive months and win exclusive perks!" |

Offer | Early Access Perks: First 10,000 users get free insights/premium reports on trending stocks & ETFs. | NA |

|

|

|

Frequency & Timing | 📅 Pre-Launch (2 weeks prior): Teasers on social media, email, and push notifications ("Something big is coming!").

|

|

|

|

|

Success Metrics | ✅ Feature Adoption Rate – % of users engaging with Paisa Buddy. |

|

|

|

|

Retention for INDmoney 💸>

Retention is a function of below user parameters:

- More the awareness and knowledge of different financial instruments > More inclination towards investments, portfolio management and diversification > hence aligned to CVP(super money app for all things money)

- Age > 28-50

- Acquisition Channels > Referrals since trust is paramount in dealing with financial instruments

- Product features > US stocks[Since Vested is the only other platform which provides this, there would be higher chances of retaining such customers], Tracking new assets[Implies that user is inclined towards tracking their portfolio and this is a differentiating feature for INDmoney]

Top reasons for churn

Definition of churn > User who has done ANY of the core actions below and has no longer done any in the last X months:

- Transaction > Has done at least one successful order on the app since inception

- Tracking > Has done at least one user-initiated asset linking since inception

Reasons | Impact | Frequency | Source - Sample reviews on App store and Play store, Forums etc. | Voluntary | Involuntary |

|---|---|---|---|---|---|

Technical glitches and app performance issues

| Glitches disrupt user workflows, particularly for time-sensitive activities like trading, causing frustration and financial loss. | High |

| ✅ | |

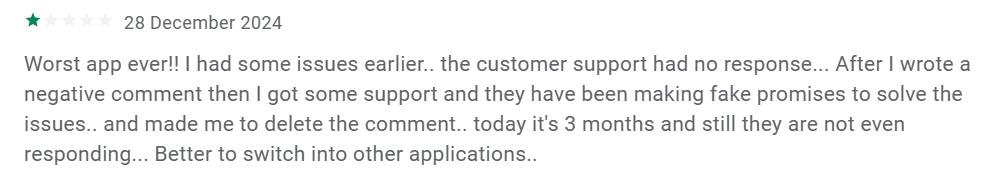

Dissatisfaction with customer service

| Unresolved queries erode user trust and deter long-term engagement with the platform. | High |

| ✅ | |

Transaction and Data Accuracy Issues

| Errors in financial data undermine the app’s credibility, leading users to question its reliability. | High | ✅ | ||

Challenges in onboarding and difficulty in KYC process

| Difficult onboarding discourages new users from completing registrations, reducing potential user acquisition. | Med |

| ✅ | |

Privacy and trust concerns

| Trust issues significantly increase churn as users seek more transparent alternatives. | Med | https://www.reddit.com/r/IndianStockMarket/comments/1891mqk/is_ind_money_app_a_scam/ | ✅ | |

Complex UI/Unclear Navigation | Med-Low |

| ✅ | ||

Money withdrawal issues | Med-Low | https://www.reddit.com/r/IndiaInvestments/comments/qwk8sb/unethical_unprofessional_experience_from/ | ✅ | ||

Moved outside India - Don't have time or don't want to invest in Indian equity | Low | ✅ | |||

Pricing/charges better for competitor | Low | ✅ | |||

No longer have money/time to invest like on a break/higher education/new expenses or EMIs | Low | ✅ | |||

Market un-stability/increased volatility | Med(Hypothesis) | Macro factors + Beginners may panic and stop using | ✅ |

Resurrection Campaigns 🤗 >

Campaign 1 | Campaign 2 | Campaign 3 | |

|---|---|---|---|

Target Reason for Churn | Unsatisfied Customer Support Experience | Technical glitches and app performance issues | Challenges in onboarding and difficulty in KYC process |

Target "At-risk" user segment👥 | Users who faced issues with customer support in terms of both Effectiveness and Efficacy. | Users who faced app crashes, slow performance, or login/logout issues leading to frustration. | Users struggled with KYC verification, leading to drop-offs in onboarding. |

How to identify "At-risk" users |

|

|

|

Approach | Reduce friction | Reduce friction + Incentive | Reduce friction |

Pitch 🎯 | "Your voice matters! We’ve improved our customer support – faster, smarter, and always there for you." | "The new INDmoney is here – 2x faster, 50% fewer crashes, and a seamless investing experience!" | "Investing should be simple. Complete KYC in 2 minutes and unlock your free ₹250 bonus!" |

Offer Construct 🎁 | ✅ Priority Support Access: Fast-tracked response for returning users. | ✅ ₹100 Cashback for First Investment After Return | ✅ ₹250 Investment Bonus for completing KYC. |

App/Operational changes ⚙️ | 🔹 Live Chat & WhatsApp Integration for real-time issue resolution. | 🔹 Bug Fix Sprint: Resolve top-reported glitches & crashes. | 🔹 AI-Powered Document Verification – reduces manual review time. |

Frequency & Timing 📅 | 📩 Email & Push Notification: "We’ve Fixed Our Support – Ready to Assist You in 48 Hours!" (Sent 3x over 2 weeks) | 📩 Push Notification: "INDmoney is now lightning-fast! Ready to invest?" | 📩 Push Notification: "Complete KYC in 2 minutes & get ₹250 for your first investment!" |

Success Metrics 📊 | ✅ Ratio of resolved tickets /Overall tickets ✅ Avg. # Tickets getting opened per day ✅ TAT for ticket resolution | ✅ % of returning users engaging with the app post-campaign ✅ Avg. # Tickets linked to glitches/crash getting opened per day | ✅ % of users completing KYC after campaign |

THE END.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.